Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

As the editor-in-chief of PressBrakeGuide.com, I’ve had the privilege of walking countless factory floors, from bustling high-volume production lines to meticulous aerospace job shops. I’ve seen these incredible machines evolve from simple, manually-operated hydraulic workhorses into the hyper-precise, automated bending cells that power modern industry. When we set out to analyze the “Global Press Brake Market”, it’s easy to get lost in the numbers—billions of dollars, compound annual growth rates, and market share percentages. But to truly understand this market, we must look beyond the spreadsheet.

The entire press brake industry, from its current size to its future forecast, revolves around one central, undeniable theme: Precision Metal Forming.

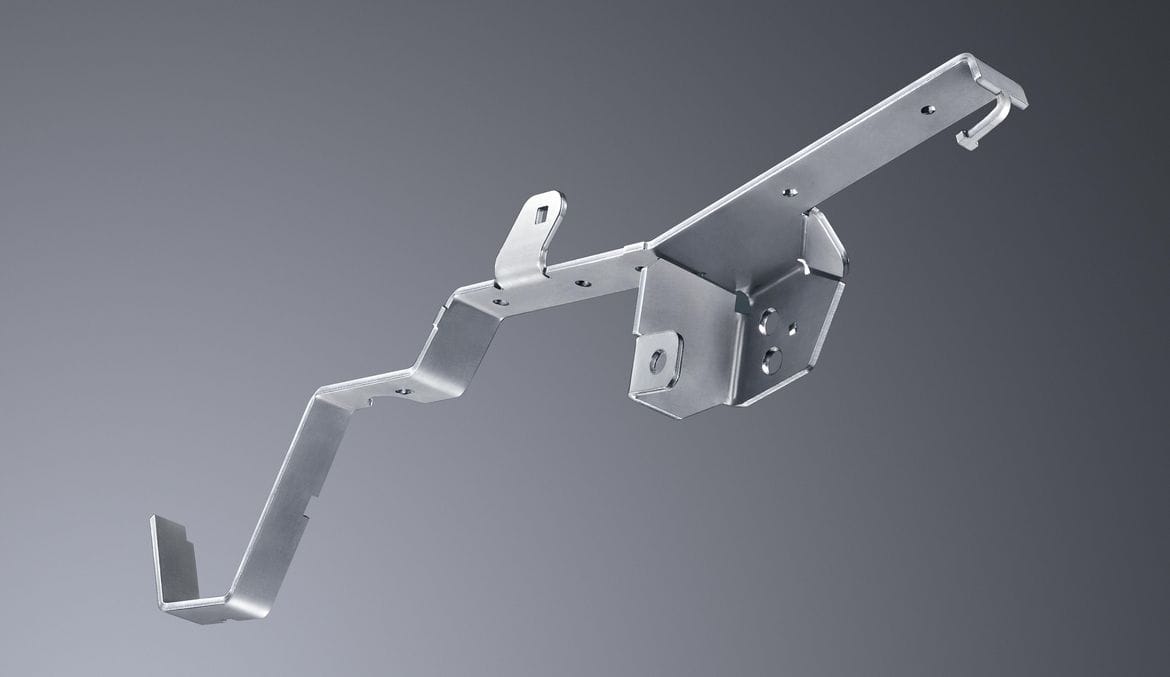

This isn’t just a buzzword. “Precision Metal Forming” is the core driver behind every major innovation, every significant investment, and every purchasing decision in this space. It’s the answer to why the market is growing. Manufacturers are no longer just “bending” parts; they are under immense pressure to produce more complex, accurate, and repeatable components, on the first try, with less waste, and using lighter, stronger, and more difficult-to-work-with materials.

This article will serve as your comprehensive guide to the global press brake market. We will dissect its current valuation, explore the technological revolutions driving its growth, segment the market by machine type and end-use industry, analyze key regional trends, and provide a clear forecast for the coming years. And we will do it all through the lens of this relentless pursuit of precision.

Before we can forecast the future, we must have a crystal-clear picture of the present. The global press brake market is a robust and surprisingly complex ecosystem. It’s not just a single, monolithic entity but a dynamic interplay of technology, economic forces, and industrial demand.

First, it’s critical to define what we mean by the “press brake market.” When market research firms, such as Fortune Business Insights or Grand View Research, publish their reports, the headline number—the total market size—encompasses more than just the sale price of new machines.

This figure is a composite of several key revenue streams. It includes new machine sales, which form the largest slice of the pie. This covers the entire spectrum, from small, 40-ton electric machines to massive, 3000-ton tandem hydraulic presses. But it also includes the critical aftermarket. This involves revenue from spare parts, routine maintenance, and service contracts, which provide a stable, recurring income for manufacturers. Furthermore, it accounts for software sales—the offline programming and simulation suites that are now indispensable for efficient production. Finally, it also loops in tooling (punches and dies) and significant retrofits or upgrades, where older machines are given new life with modern CNC controllers or safety systems. Understanding this composite nature is key to seeing the market’s true scale and resilience.

So, what is the market worth today? Based on a synthesis of recent industry reports and our own channel checks, the global press brake market size was valued at approximately USD 2.1 Billion in 2023. This figure represents the total annual revenue generated by all the components we just discussed.

To put this number in perspective, it reflects the global manufacturing industry’s deep and ongoing commitment to sheet metal fabrication. It’s a foundational technology. You cannot build a modern car, airplane, HVAC system, or piece of electronic equipment without precisely formed metal components. This $2.1 billion baseline is the “cost of entry” for the modern industrial world. It is from this robust foundation that all future growth is projected. This valuation is a testament to the machine’s essential role, a role that has only been solidified by recent global trends.

It is impossible to discuss the current market without addressing the immense disruptions and subsequent recovery from the COVID-19 pandemic and its related supply chain snarls. The 2020-2022 period was a story of extremes. After an initial sharp pause, demand for manufactured goods skyrocketed. This was driven by everything from stimulus-fueled consumer spending on appliances to massive investments in data centers and logistics infrastructure.

This surge in demand created a “bullwhip effect” that hit press brake manufacturers hard. While order books filled up at an unprecedented rate, factories struggled to get the components to build the machines. Microchips for CNC controllers, high-quality hydraulic valves, and even basic electrical components were subject to lead times that stretched from weeks to months, sometimes over a year. As an industry insider, I heard countless stories of nearly-finished machines sitting on assembly floors, waiting for a single, delayed part. This friction had two major effects on the market valuation: it artificially suppressed the number of machines that could be shipped, and it simultaneously drove prices up, with manufacturers forced to pass on their own skyrocketing costs for raw materials and expedited freight.

While supply chain chaos defined the short-term, it also masked and, in many ways, accelerated the real, long-term drivers of the market. The pandemic exposed the fragility of long-distance supply chains, triggering a massive strategic rethink in boardrooms worldwide. This has given serious momentum to “reshoring” and “near-shoring” initiatives, particularly in North America and Europe. Companies are now actively investing in bringing key manufacturing capabilities back home or closer to home, and this almost always involves new capital expenditure on fabrication equipment like press brakes.

More importantly, this new investment isn’t just about adding capacity; it’s about adding smarter capacity. The other major post-pandemic reality is a persistent skilled labor shortage. Fabricators can no longer rely on finding “master” press brake operators with 20 years of experience. They need machines that are easy to program, fast to set up, and accurate on the first part. This is where our core theme, Precision Metal Forming, re-enters the picture as the primary, sustainable driver of market growth, long after the short-term supply chain noise fades. The demand is for machines that embed the “skill” in the technology itself, and that is what will fuel the market for the next decade.

The $2.1 billion market valuation is not static; it’s the result of a constant technological arms race. As an engineer at heart, this is the part of the market I find most fascinating. The growth we’re forecasting isn’t just because companies are buying more press brakes; it’s because they are buying better, more expensive, and infinitely more capable press brakes. The premium that manufacturers are willing to pay for speed, efficiency, and, above all, precision, is the engine of this market.

This evolution is most visible in the machine’s core drive system. For decades, the conventional hydraulic press brake was the undisputed king, and for good reason. It’s a powerful, relatively simple, and cost-effective design. However, its limitations in a precision-focused world have become apparent. Traditional hydraulics can be slower on approach and retraction, are energy-intensive (the pump often runs continuously), and can be challenging to control with the sub-millimeter accuracy needed for complex parts. This has opened the door for new technologies to capture significant market share.

The single most important technological trend in this market is the move away from purely hydraulic systems. This shift is creating new product categories and pricing tiers.

Full-Electric Press Brakes: These are the disruptors. Instead of a hydraulic pump and cylinders, electric press brakes use high-performance servo motors and ball-screw or belt-pulley systems to drive the upper beam (ram). As someone who has operated these machines, the difference is night and day. They are incredibly fast, with ram speeds often double or triple that of their hydraulic counterparts. They are also exceptionally quiet and remarkably energy-efficient, often consuming 50% less power because they only draw energy when the beam is in motion.

But their real selling point is precision and repeatability. The servo-motor control is absolute. The machine can position the ram with accuracy measured in microns (thousandths of a millimeter). This makes them the clear choice for bending small, complex parts for the electronics, medical, and aerospace industries. While they are currently limited in tonnage (typically capping out around 300 tons, with a sweet spot under 150), they are dominating the high-precision, low-tonnage segment.

Hybrid Press Brakes: These machines represent a “best of both worlds” compromise and are, in my opinion, the future of the mainstream market (100-300 tons). A hybrid system, like those pioneered by companies such as SafanDarley, combines the power of hydraulics with the efficiency and control of servo-electrics.

Here’s a simple breakdown: a high-speed, energy-efficient servo-electric motor drives a hydraulic pump. This “on-demand” system only activates the pump when the operator steps on the foot pedal. This immediately solves the energy waste problem. This compact hydraulic system then actuates the main cylinders. This design allows for the high tonnage capacities of a hydraulic machine but with the speed, acceleration, and precise ram control of an electric one. They are fast, accurate, and efficient, and they represent a significant portion of new machine sales in the mid-tonnage range.

The “Modern” Hydraulic: Even the traditional hydraulic press brake has evolved. New machines from leading manufacturers like TRUMPF or Bystronic bear little resemblance to their predecessors. They feature high-speed valves, variable-speed pumps that reduce energy consumption, and integrated control systems that make them faster and more accurate than ever. While they are losing ground to electric and hybrid models, they remain the only viable solution for the high-tonnage and ultra-high-tonnage applications (400 to 3000+ tons) required in shipbuilding, heavy construction, and defense.

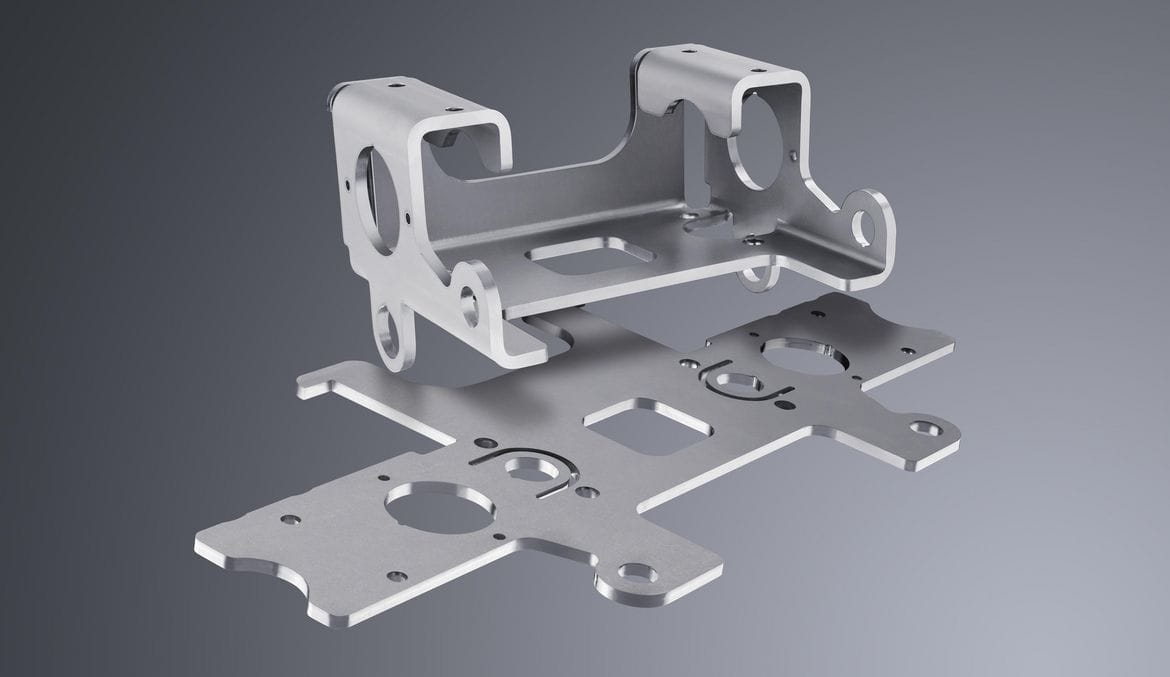

A press brake’s drive system is its muscle, but the CNC (Computer Numerical Control) is its brain. This is where the “skill” is being digitized. Today’s top-tier controllers, from industry leaders like Delem or Cybelec, are powerful touchscreen PCs. They allow an operator to import a 3D CAD model (like a STEP or IGES file) directly into the control.

The control’s software then automatically unfolds the 3D part, calculates the required bend angles and flange lengths, determines the optimal bend sequence, and simulates the entire process in a 3D virtual environment. It will automatically flag potential collisions between the part, the tooling, and the machine frame. The operator can see the entire job run virtually before a single piece of metal is touched.

This single innovation has done more to solve the skilled labor gap than any other. It dramatically reduces setup time. An operator no longer needs to be a master of trigonometry and “black art” bend deductions. The software does the heavy lifting, allowing a less-experienced operator to become productive in days, not years. This software-driven capability is a huge value-add and a major contributor to the rising average sale price of new machines.

The final piece of the precision puzzle is the “closed-loop” system. In a perfect world, if you program a 90-degree bend, you get a 90-degree bend. In reality, you don’t. Every piece of metal has slight variations in thickness, tensile strength, and grain direction. This is known as “springback.” A 90-degree bend might spring back to 91.5 degrees.

Furthermore, every press brake, no matter how rigid, will deflect (flex) in the middle when under tons of force. This means a part bent in the center of the machine will have a slightly different angle than a part bent near the ends.

The market has solved these problems with two key technologies that are now standard on mid- to high-end machines:

To truly grasp the $2.1 billion market, we must break it down into its constituent parts. The needs of a small job shop making brackets are vastly different from an automotive OEM stamping body panels. By segmenting the market, we can see where the growth is most concentrated and which technologies are winning in which applications.

We’ve already touched on the core technologies, but their market share reveals the current state of the industry.

Hydraulic Press Brakes: This segment, while mature, still commands the largest share of the market by revenue, primarily due to its absolute necessity in high-tonnage applications. The sales of machines over 300 tons, which are almost exclusively hydraulic, are high-value transactions that anchor this segment. However, in terms of unit volume, its dominance is clearly eroding. Its growth is now the slowest in the market, as many of its traditional applications in the low- and mid-tonnage brackets are being lost to hybrid and electric machines.

Electric Press Brakes: This is, without question, the fastest-growing segment of the entire press brake market. Its growth is explosive, driven by the “three E’s”: Efficiency (low energy use), Ergonomics (quiet, clean, low maintenance), and Extreme Precision. The demand from the electronics, medical device, and small-part automotive industries is insatiable. As I mentioned, the primary limitation is tonnage, but as manufacturers continue to push those limits, we expect the electric segment to continue to steal share from hydraulics at an accelerating pace.

Hybrid Press Brakes: This segment is also experiencing very strong growth. It is capturing the “sweet spot” of the market: fabricators from 100 to 300 tons who need more speed and precision than a traditional hydraulic machine can offer but who cannot be limited by the tonnage caps of an all-electric. These machines are the new “workhorse” for high-production job shops and general manufacturers. They offer a clear and compelling return on investment (ROI) through their combination of speed and energy savings, making them an easy upgrade to justify.

Mechanical/Pneumatic Press Brakes: This is a legacy market segment. While mechanical press brakes are still in operation all over the world (a testament to their durability), new sales are minimal and typically confined to very specific, high-speed, low-tonnage applications like stamping. Pneumatic (air-powered) press brakes are a niche product for very light-gauge bending. This segment holds a negligible share of the new market value and is not a factor in future growth projections.

Breaking the market down by bending force, or tonnage, gives us a clear view of the application landscape.

Low Tonnage (0-100 Tons): This segment is almost entirely dominated by electric press brake technology. This is the domain of intricate, high-precision bending. Think of electronic chassis, small enclosures, medical implants, and complex brackets. The parts are small, the material is thin, and the tolerances are extremely tight. Speed and repeatability are the key purchasing drivers, and the premium price for electric machines is easily justified.

Medium Tonnage (100-300 Tons): This is the largest and most competitive segment of the market. It’s the territory of the general fabrication job shop and the majority of OEM manufacturers. The machines here need to be flexible—able to bend 1/4-inch steel plate one minute and thin aluminum the next. This is where the battle between high-end hydraulic and new hybrid machines is being fought. The trend is strongly in favor of hybrids, which offer the versatility and power these shops demand, but with the added benefits of speed and efficiency.

High Tonnage (300 Tons and Above): This segment is the bastion of hydraulic technology. The applications here are all about heavy-duty power. We’re talking about forming structural components for construction and agriculture, bending thick plate for shipbuilding and defense applications, and fabricating large-scale infrastructure like wind turbine towers. These are high-value, custom-built machines, and while the number of units sold is much lower than in other segments, their high price tag gives this segment significant weight in the overall market valuation.

Finally, looking at who is buying the machines—the end-use industry—connects the technology to the real-world economy.

Automotive: The automotive industry is a massive consumer of press brakes, but its needs are twofold. On one hand, Tier 1 and Tier 2 suppliers use high-speed, automated, and often electric press brakes to produce vast quantities of smaller components. On the other hand, the shift to Electric Vehicles (EVs) has created new demand. The “skate” chassis of an EV requires large, complex, and incredibly strong formed parts for battery enclosures, often made from high-strength steels (HSS) that require high-tonnage, high-precision hydraulic presses.

Aerospace & Defense: This industry, while not the largest in volume, is the absolute pinnacle of the “Precision Metal Forming” trend. They are bending exotic materials like titanium and Inconel, where a single part can be worth thousands of dollars. There is zero tolerance for error or scrap. This industry exclusively buys high-end machines equipped with every available precision tool, including in-process angle correction and full 3D simulation. They are a primary driver of high-end technological innovation.

General Manufacturing & Job Shops: This is the backbone of the market. This segment is highly fragmented, consisting of thousands of small and medium-sized businesses that serve all other industries. Their primary need is flexibility. Because they never know what job will come in the door next, they require machines that are easy to program and fast to change over. The adoption of offline programming and hybrid machines has been a lifeline for these shops, allowing them to compete and thrive despite the skilled labor shortage.

Construction & Agriculture: This is a high-tonnage market. Manufacturers of heavy equipment (like Caterpillar or John Deere) and structural steel fabricators are bending thick, high-strength plate. Their primary purchasing driver is power, durability, and reliability. They are the main customers for the large hydraulic presses we discussed earlier.

Electronics & Medical: This is the heart of the high-speed, low-tonnage electric press brake market. The trend toward miniaturization in electronics and the demand for complex, sterile components in the medical field have created a booming market for machines that can deliver micrometer-level precision on very small parts.

The press brake market is not uniform across the globe. Different regions are at different stages of industrial development and face unique economic pressures. As someone who has worked in global sales, I can attest that the machine you sell in Germany is often very different from the one you sell in India or Brazil. A clear regional analysis is essential to understanding the global forecast.

The Asia-Pacific region, encompassing manufacturing powerhouses like China, Japan, South Korea, and India, is unequivocally the largest press brake market in the world. It holds the dominant market share, and this is not surprising given that it is the “world’s factory.”

China, in particular, is a massive market. Its internal demand is driven by colossal industries in automotive, electronics, and heavy construction. For years, this market was focused on volume and cost, absorbing a huge number of basic, inexpensive hydraulic presses. However, a significant shift is underway. Rising labor costs and a government-led push for higher-quality, “Made in China 2025” manufacturing are driving a massive wave of technological upgrading. This has created a booming market for high-end, automated, and precision-oriented machines, a trend that both domestic Chinese manufacturers and European/Japanese exporters are capitalizing on.

Japan and South Korea, by contrast, are mature, high-technology markets. Their advanced automotive and electronics sectors demand the absolute best in precision and automation. These countries are often early adopters of the newest technologies, with a high penetration of electric and hybrid press brakes and a deep integration of robotics.

India is one of the fastest-growing markets in the region. Driven by the “Make in India” initiative and a burgeoning industrial base, the demand for fabrication equipment is strong. This market is currently very price-sensitive but is rapidly moving from low-cost basic machines to mid-range CNC press brakes as quality and export demands increase.

Europe, particularly with its industrial heartland in Germany, Italy, and Turkey, is the second-largest market. This region is defined by its focus on quality, automation, and stringent standards.

Germany, the home of Industry 4.0, is a market leader in technological adoption. German manufacturers in the automotive, machinery, and industrial goods sectors demand machines that are not just precise, but also fully networked and “smart.” They are leaders in integrating press brakes into fully automated bending cells, complete with robots for loading, bending, and stacking. Energy efficiency and operator safety (adherence to CE-marking standards) are also paramount purchasing considerations.

Italy has a long and proud history of press brake manufacturing and is home to several world-class brands. The market is similar to Germany’s, with a strong focus on high-end, flexible solutions for its powerful machine-tool and luxury goods industries.

Turkey has emerged as a major global player, both as a manufacturer and a market. Turkish press brake builders have become formidable competitors, offering machines with advanced features at a highly competitive price point. This has made them a dominant force not just in their home region but also in exports to North America and the rest of Europe. The domestic market itself is strong, driven by a robust manufacturing sector.

The North American market, consisting of the United States, Canada, and Mexico, is the third-largest region. This market is characterized by two powerful, concurrent trends: modernization and the skilled labor crisis.

For decades, many North American factories operated with aging equipment. That is changing fast. The “reshoring” or “near-shoring” of manufacturing, spurred by the supply chain shocks of recent years, has triggered a significant wave of capital investment. Companies are building new, modern factories and are prioritizing automation to insulate themselves from future disruptions and the high cost of labor.

This leads to the second, and perhaps most powerful, driver: the skilled labor shortage. I have personally visited dozens of shops in the US that had million-dollar order backlogs but simply could not find experienced operators to run the machines. This has created a desperate demand for press brakes that are “easy to run.” The market for machines with advanced CNC controllers, 3D simulation, and offline programming is white-hot. Fabricators are willing to pay a premium for any technology that reduces setup time and allows a new operator to become productive quickly. This makes North America a prime market for high-end hybrid and electric machines loaded with the latest software.

This segment includes South America, the Middle East, and Africa. These are emerging markets, each with its own distinct character.

South America, with Brazil as its largest player, is a market driven by commodities and general industrialization. The demand is often for robust, simple-to-maintain hydraulic presses for agriculture and construction. However, its growing automotive and aerospace sectors are creating pockets of demand for more advanced technology.

The Middle East, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in diversifying its economy away from oil. This has led to massive government-backed projects in infrastructure, transportation, and manufacturing, creating a steady demand for a wide range of fabrication equipment, including high-tonnage presses for structural work.

Africa remains a small, nascent market for new press brakes, with demand largely concentrated in South Africa. The market is dominated by basic, entry-level machines, but it holds long-term potential as industrialization slowly takes root.

The global press brake market is a highly competitive arena, populated by established giants, nimble innovators, and aggressive value-focused challengers. From my vantage point, the competition isn’t just on price; it’s on R&D, service, and full-suite solutions.

At the top of the market, you have a group of companies that are synonymous with sheet metal fabrication. These are brands like TRUMPF, Amada, and Bystronic. These companies compete on the basis of all-out technological leadership. They were the first to integrate lasers, automation, and advanced software into their product lines.

Their strategy is not just to sell a press brake, but to sell a total fabrication solution. They offer a “one-stop-shop” for manufacturers, providing the laser cutter, the press brake, the automation, the software, and the global service network to tie it all together. Their R&D budgets are enormous, and they are the ones pioneering the most advanced “Industry 4.0” features. They command a premium price and are the preferred choice for large, well-capitalized corporations that value service and interoperability above all else.

Just behind the “big three,” there is a very strong tier of manufacturers known for exceptional quality and innovation in the press brake space specifically. This includes companies like LVD, which has a reputation for powerful, high-end hydraulic and hybrid machines, and SafanDarley, the pioneer of the E-Brake (electric) and a leader in that segment. These companies are deep specialists. They live and breathe bending, and their machines are respected by operators worldwide for their performance and durability.

This tier also includes the aforementioned Turkish manufacturers, such as Dener or Ermaksan, who have aggressively captured global market share by offering machines with a high number of features (like advanced CNCs and crowning) at a price point that is very difficult for the established leaders to match.

The market is in a constant state of flux. We have seen some consolidation, with larger companies acquiring smaller, specialized technology firms (for example, to bring a specific tooling or software capability in-house).

At the same time, the market is large enough to support many successful niche players. There are companies that specialize only in high-tonnage custom presses, or only in small, manual press brakes for R&D shops. This complex and varied competitive landscape is ultimately a healthy sign, as it gives buyers a wide range of options and ensures that innovation remains a top priority for all manufacturers. The battle for market share is what funds the R&D that fuels the entire “Precision Metal Forming” trend.

This brings us to the final and most critical question: Where is the market heading? We have established its current size, dissected its technological drivers, and mapped its regional and industrial segments. Now, we will synthesize this data into a clear, forward-looking forecast.

Based on the powerful, compounding drivers we’ve analyzed—the skilled labor shortage, the reshoring trend, and the relentless demand for higher precision from all end-use industries—the forecast for the press brake market is exceptionally strong.

Leading market analysts project a Compound Annual Growth Rate (CAGR) for the global press brake market of between 4.5% and 5.5% over the next five to seven years.

Let’s translate that into real-world numbers. Starting from our 2023 baseline of USD 2.1 Billion, a conservative CAGR of 5.0% would grow the market to over USD 2.68 Billion by 2028. This represents more than half a billion dollars in new, annual revenue. From my perspective as an industry veteran, this forecast feels not only achievable but potentially conservative. The fundamental need to automate and improve precision is a tailwind that shows no signs of slowing down. This steady, sustainable growth makes the press brake market a very healthy and stable sector within the broader machine-tool industry.

The future growth of this market will not come from selling more “dumb” machines. It will come from selling “smart,” connected, and increasingly autonomous bending solutions. The trends we’ve discussed are only the beginning.

Full Automation & Robotics: The next frontier is the fully automated “lights-out” bending cell. While robotic press brake tending is already common, the software is becoming much more intelligent. We are moving toward systems where a robot can not only load and unload the part but also automatically change the press brake tooling between jobs. This is the holy grail for high-mix, low-volume job shops, as it would allow them to run production 24/7 with minimal human intervention. Companies like Amada and others are already showcasing advanced systems like this.

AI and Adaptive Manufacturing: The in-process angle correction we discussed is a form of adaptive technology. The next step is true AI. Imagine a press brake that can use a vision system to identify a blank part, measure its exact material properties (thickness, tensile strength) on the fly, and then instantly adapt its own bending parameters to guarantee a perfect part, even if the material is from a different batch or supplier. This would eliminate the last variables of “tribal knowledge” and make the machine truly self-sufficient.

IoT and Predictive Maintenance: Finally, the “Industry 4.0” push is all about data. Every new press brake is a connected “node” on the factory network. These machines are constantly reporting their own health: hydraulic pressure, motor temperature, cycle counts, and error logs. This data is fed into predictive maintenance algorithms. The machine will eventually be able to “self-diagnose” an impending failure—for example, “My pump vibration has increased 20%; I will likely need a new bearing in the next 72 operating hours.” This allows factories to schedule maintenance before a catastrophic, line-stopping failure, saving an immense amount of time and money.

The global press brake market is far from being a “boring” or “mature” industry. It is a vibrant, technologically advanced, and growing market that is fundamental to all modern manufacturing.

The market’s projected growth to over $2.68 billion by 2028 is not built on speculation. It is built on a solid foundation of global industrial demand. The transition from basic hydraulic machines to fast, efficient, and precise electric and hybrid models is accelerating. The integration of powerful software and intelligent sensors is solving the skilled labor crisis by digitizing the “art” of bending into a repeatable science.

As we look to the future, the press brake is solidifying its role as a smart, connected, and indispensable tool in the Factory of the Future. The core keyword we began with, Precision Metal Forming, is the guiding principle. The manufacturers who can deliver that precision, efficiency, and intelligence will be the ones who lead the market into its next, prosperous chapter.

A press brake is a big machine used in factories to bend metal pieces into different shapes. Think of it like a giant pair of scissors that cuts metal, but instead, it gently bends it. This bending is done very carefully to make sure the metal parts fit together perfectly when making things like cars or airplanes.

Precision is super important because it ensures that every metal part is made exactly right. If a part is even a tiny bit off, it might not fit well with other pieces, causing problems later. In industries like automotive and aerospace, the accuracy of parts can impact safety and performance, making precision a big deal.

There are mainly three types of press brakes: hydraulic, electric, and hybrid. Hydraulic press brakes use fluid pressure to bend the metal and are great for heavy jobs. Electric press brakes use motors and are faster and quieter. Hybrid press brakes combine both systems, offering the benefits of both types.

The press brake market has changed a lot, particularly due to technological advancements. Machines are becoming smarter and more efficient, allowing them to make complex parts more easily. There’s also been a push for using machines that require less skilled labor, making it easier for factories to operate.

Experts forecast the press brake market will grow significantly, reaching around $2.68 billion by 2028. This growth is driven by the increasing demand for precision and efficiency in manufacturing, as companies look to improve their production processes.

Press brakes are used in many industries like automotive, aerospace, construction, and electronics. Each industry has different needs — for example, the automotive industry requires a lot of precise small parts, while construction needs heavier and stronger components.

Press brakes are helping with the shortage of skilled workers by becoming easier to use. New machines come with advanced software that guides operators, making it possible for someone with less experience to control them effectively and produce quality parts quickly.

Technology plays a huge role in making press brakes better, faster, and more precise. New software helps run machines automatically, and innovative features like sensors ensure that parts are bent correctly every time. This technology is making factories smarter and more efficient.

The press brake market faces challenges such as supply chain issues, which can delay the production of machines. There’s also competition from countries like China, which is rapidly growing its manufacturing capabilities. These factors can affect how quickly the market grows.

Precision metal forming is the key to making high-quality products in modern industries. It ensures that parts fit together perfectly, which is essential for the performance and safety of the end products, whether they’re cars, planes, or electronic devices.